Jewel-Osco stores will be sold to a consortium of investors led by Cerberus Capital Management, Jewel's parent Supervalu said Thursday.

The deal, valued at $3.3 billion, also includes the Albertsons, Acme, and Shaw stores.

The announcement ends months of speculation that all or parts of the troubled grocery chain would be sold to New York-based Cerberus, an investment firm. Supervalu acquired Jewel in 2006 as part of a larger, complex acquisition of the Albertsons company.

Supervalu also reported earnings of $16 million, or 8 cents per share, in the third quarter ended on Dec. 1, compared with a year-earlier loss of $750 million, or $3.54 per share.

Excluding an after-tax gain related to a cash settlement from credit card companies and after-tax charges primarily related to store closures, it earned $5 million, or 3 cents per share.

As part of the deal, which includes $100 million in cash and $3.2 billion in debt, the five grocery chains will be acquired by AB Acquisition, an affiliate of Cerberus. Other investors in the deal include Kimco Realty Corp, Klaff Realty, Lubert-Adler Partners and Schottenstein Real Estate Group.

Following the sale, which is expected to close in the spring, a newly formed entity called Symphony Investors, led by Cerberus, will purchase up to 30 percent of Supervalu's outstanding shares for $4 each, representing a 50 percent premium over the stock's 30-day average. If Symphony cannot acquire at least 19.9 percent of the outstanding shares at that price, Supervalu must issue additional stock.

Wall Street has long expected Eden Prairie, Minn.-based Supervalu to sell some or all of its assets.

Following the deal, Supervalu will consist of its wholesale grocery business, the Save-A-Lot discount chain, and traditional grocery chains like Cub, Shop N' Save and Hornbacher's.

In a call with investors, outgoing CEO Wayne Sales said the deal brings Supervalu "a very strong balance sheet," and the ability to focus on investments in price reductions, fresh produce, and customer experience at its remaining chains.

The new company is smaller, "with more bandwidth and leadership" to focus on its wholesale business, Save-A-Lot, and its traditional grocery stores, he said.

Sam Duncan, 61, will replace Wayne Sales as CEO. Duncan was CEO of Office Max from 2005 to 2011, and prior to that, was CEO of ShopKo, a Midwestern grocery chain. Five unidentified board members will resign as part of the deal, making room for Duncan, Albertsons CEO Robert Miller, and three new appointees. The size of the board will shrink from 10 to seven.

Concurrent with the announcement, Supervalu announced that it has secured access to a $900 million asset-based credit facility, and a $1.5 billion loan.

This deal ends a long and difficult year for one of the country's largest grocers.

Last April, Supervalu reported a loss of $1.04 billion for fiscal 2012, which included a $519 million operating loss and $509 million in interest expense. Sales also declined 3 percent, to $27.9 billion. In July, the company said it was exploring strategic alternatives, including a sale. Soon after, the company dismissed CEO Craig Herkert, with Chairman Wayne Sales stepping in to helm the troubled grocer.

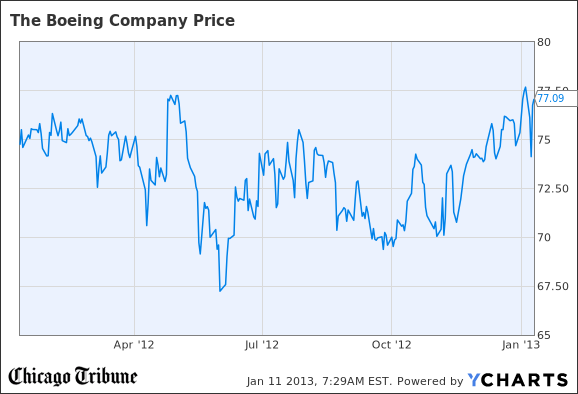

Cerberus, an investor in the deal to acquire Albertsons in 2006 was long seen as the leading candidate. Last week, rumors that Supervalu was near a deal with Cerberus sent stock soaring nearly 15 percent.

In September, Supervalu said it would 60 underperforming stores, primarily from the Save-A-Lot and Albertsons chains. No Jewel locations were identified at the time. The announcement was particularly troubling to investment community because Save-A-Lot, a hard discount chain, has been Supervalu's primary growth vehicle.

Supervalu has long acknowledged that many of its stores are not price competitive. In 2012, it homed in on Jewel-Osco and the Chicago market. Supervalu surveyed customers and lowered prices throughout the store. When the company reported results for its second fiscal quarter in September, (Supervalu CEO Wayne) Sales said that Jewel had been "competitively priced throughout the store" for about six weeks.

Sales said that the initiative had resulted in "dramatic improvement" in how consumers "think about the quality of products we sell, how they feel about the service they get in various departments" and that the company was pleased with increased unit sales.